Welcome to Kingston Harrop

We are an Accounting Practice in every sense that this engenders plus much more. When it comes to business and taxation advice, we have accumulated an extraordinarily diverse range of skills and knowledge across a multitude of industries. In addition, our engagement with other professionals and services ensures we can support the expanding and complex needs of clients.

The firm was established in January 2002 by Darren Harrop who remains the principal of the practice. Quality people have been added to the team which is what gives this business its ultimate strength. We pride ourselves on being able to provide a comprehensive range of professional services in a prompt and efficient manner.

Learn more about Who We Help, What We Do, Our Trusted Partners, stay up-to-date with our Latest News articles, or Contact Us if you want to ask a question or book an appointment.

Who We Help

We are most pleased to assist individuals, families and the many varied business and investment structures. We also value our opportunities to work with charities and other associations.

We find, in the most part, that people are referred to us by existing clients. There is a focus on the individual and their family that stands out as a key feature of why our advice matters. There is no taxation issue, business matter, superannuation law, or company need that does not ultimately flow back to the individuals and family that underpin any structure. We understand the flow-through impact of the vast array of financial decisions that you may face. Furthermore, we take a long-term view.

Whilst clients may not be as excited about the numbers as we are, we do have an expectation that clients have a genuine interest in improving their circumstances and achieving outcomes. As a result, we invite all clients to be proactive with us in planning for a better financial future.

What We Do

Our primary enjoyment comes from the many good and strong relationships we build with people where we are trusted to provide the right advice. This arises from taking the time to understand the particular and unique needs of each person and business. We do not make assumptions. What we do is ensure we recommend the most appropriate financial solutions and provide the applicable efficient services to back up that advice.

Please explore the diversity of services we offer and see how we can help. We welcome an opportunity to meet with you to discuss your needs.

Our intent is to partner with you in the process of managing and improving your financial affairs, whether this relates to yourself personally and/or your business and investment interests. We find our clients are eager to engage with us in undertaking the work required to make this possible.

We employ great people who bring a collective depth of experience and knowledge together with a dedication to the highest professional standards. This ensures we carry out our services with the care and attention required in a prompt and respectful manner.

We are transparent in all we do and keep clients up to date and informed.

Our Trusted Partners

There may be other matters that impact on your financial position that you would like us to assist you with. If we cannot assist you directly, we will know the right people to turn to. We often liaise with a variety of other professionals and services to ensure that our clients have the most comprehensive support and assistance possible.

Whatever your query may be regarding your financial affairs, please raise it with us. In particular, we draw your attention to the services offered by Our Trusted Partners.

Latest Accounting News

Restructuring Family Businesses: From Partnership to Limited Company

Family businesses form the backbone of the Australian economy, with many starting as simple partnerships before evolving into more complex structures

Choose the right business structure step-by-step guide

Take out the guesswork out of choosing the right structure for your business

ATO’s holiday home owner tax changes spur taxpayers to be ‘wary and proactive’

Following on from the Tax Office’s move to refresh its approach to rental property tax deductions, tax advisers are warning holiday home owners to be wary of the coming changes.

Payday Super part 1: understanding the new law

Passage of the Payday Super reforms by parliament this week has cleared the way for employee superannuation to be paid by employers more frequently. In the first of a two-part series, this article explains the myriad elements of the new law.

A refresher on Medicare levy and Medicare levy surcharge.

The Medicare levy’s a compulsory charge of 2% on taxable income, which helps fund Australia’s public healthcare system.

Protecting yourself from misinformation

The Australian Taxation Office (ATO) has observed websites attempting to harvest personal information such as Tax File Numbers, identity details and myGov login credentials under the guise of providing “super advice”.

Super gender gap slowly narrows

The latest Financy Women’s Index (FWX) for the September quarter has shown the superannuation gender gap is closing, with true parity between men and women now predicted to be achieved in a more rapid timeframe.

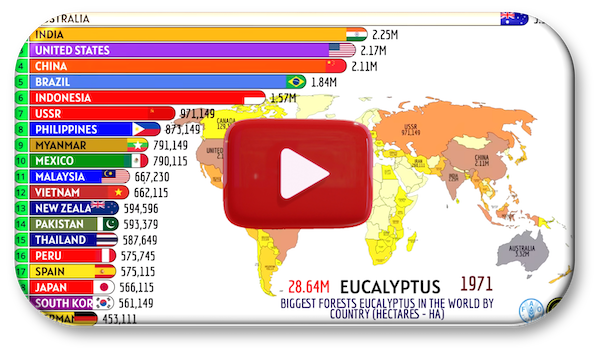

Countries with the largest collection or eucalyptus trees

Check out the countries that have started to grow their eucalyptus tree stocks

One gap when owning and operating a small business is to get a feel for how you are doing compared to your peers.

Contact Us

Kingston Harrop welcomes your enquiry. To book an appointment or simply ask us a question, fill in your details and we'll be in touch soon.

Our Office

- Suite 6, 19 Mumford Place, Balcatta WA 6021

- office@khg.com.au

- (08) 9207 6400

- (08) 9240 7807

- 9:00AM to 5:00PM, Monday-Friday

Postal Address

- PO Box 672, Balcatta WA 6914